Saleyard throughput

The sale of sheep via the saleyards has been on a downward trend for the last five years despite turn-off not declining at the same rate. This points to the use of alternative selling methods such as direct to abattoirs, use of online platforms or direct paddock sales.

Prices

Saleyard prices

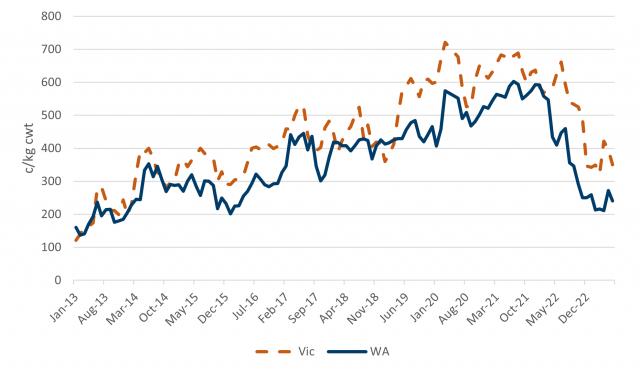

Over the last 18 months WA mutton indicators have been on a declining trend, a pattern reflected in Victorian saleyards as well. In April 2023 the WA price for mutton averaged 211c/kg, the lowest since Jan 2016. The prices started to decline following a peak of 592 c/kg in Jan 2022, however the highest on record was reached in August 2021 at 594 c/kg. In June 2023 it had lifted a little to 241 c/kg.

The falling prices may be due to reduced demand due to the large backlog of animals still awaiting processing after the labour issues experienced following the 2022 Corona outbreaks in WA.

Whilst not as marked as that seen in mutton, trade lamb saleyard prices have also declined recently. In June 2023 the trade lamb indicator averaged 474 c/kg cwt, down from a peak of 840 c/kg cwt in January 2022. This was also the highest on record. There was also a rise in value over summer when prices tipped 636 c/kg cwt in January 2023.

Wool prices

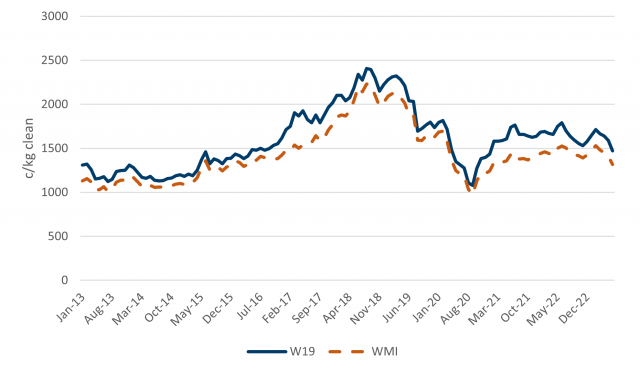

Wool prices have been relatively steady for the last 12 months after recovering from the steep decline experienced during the Covid era. Unfortunately they have not recovered to the highs seen in late 2018 when prices peaked at 2231 c/kg for the WMI and 2406 c/kg for the W19 (Aug 2018). In June 2023 the WMI averaged 1317 c/kg, down from 1409 c/kg the month before, while the W19 averaged 1471 c/kg down from 1590 c/kg.