Live sheep exports

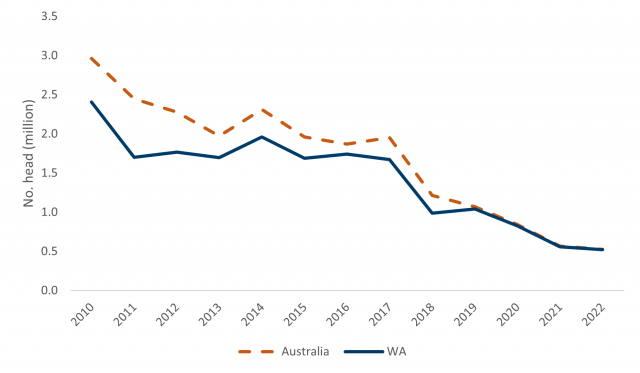

The majority of sheep exported from Australia originate in WA and 100% of sheep exported by sea are exported from Fremantle. The number of sheep exported live has been on a declining trend over the last decade or so. Sheep exported live declined from 2.6m in 2009 to 1m in 2019, a decline of 59%.

The sharp decline between 2017 and 2018 was largely due to the mid-year trade suspension and reduced stocking rates on ships imposed following the Awassi Express incident of 2017. Between 2019 and 2021 numbers declined again due to the loss of major markets such as Qatar following the removal of the subsidy for Australian sheep by the Qatari government. In 2022 live sheep exports from WA totalled 521,300, the lowest on record.

Live sheep exports are not very seasonal in nature other than the mid-year trade pause. Trade is very volatile from month to month and depends on outside factors such as available ships and international religious celebrations such as Eid/Ramadan, or even sporting events such as the World Cup.

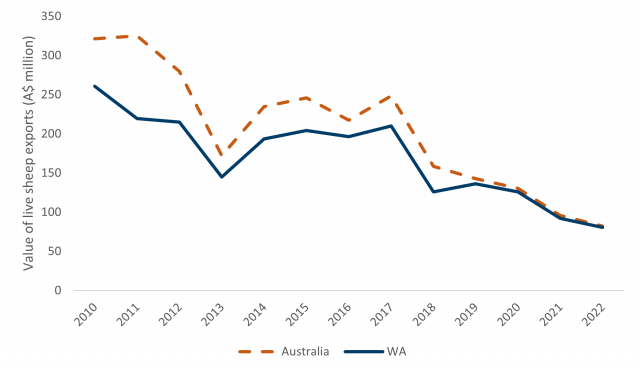

While not quite as consistent a decline as seen in the quantity of sheep exported live, there has been a likewise decrease in the value of live sheep exports, both nationally and from WA over the last decade. In 2019 live sheep exports from WA were worth $136m, but this dropped to $81m in 2022.

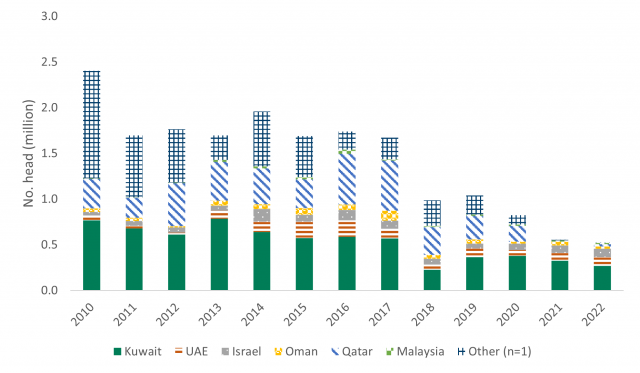

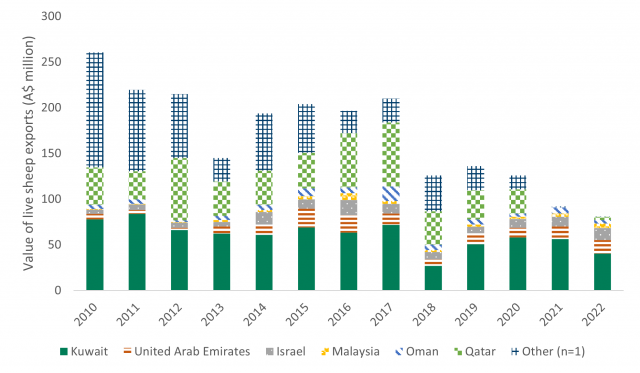

The largest market by both quantity and value for live sheep exports is Kuwait. Other than in 2018, Kuwait has been the largest market for over a decade. In 2022, WA exported 271 000 sheep worth $40.4m to Kuwait. This accounted for 52% of the quantity and 50% of the value of sheep exports. Kuwait was followed by the UAE, and Israel was the third largest market. These three markets together accounted for 88% of WA live sheep in quantity terms and 85% of the value.

Prior to 2011, Saudi Arabia and Bahrain were also large markets for live sheep from WA however, since then, both have exited the market. Oman was also much larger than it is today. It is clear that the Middle East maintains market dominance.