Summary

WA sheep industry

- The WA sheep flock numbered 12.4 million as of the 1st of July 2022 according to the ABS.

- The gross value of the sheep industry was $1.35 billion during 2021/22. This was made up of $655 million of wool and $692 million of sheepmeat, including live exports.

Slaughter

- WA Sheep and lamb slaughter totalled 3.75m in 2022. Of this 1.18m were adult sheep and 2.57m were lambs.

- Between 2010 and 2022, the highest level of slaughter reached was 4.25m in 2019. That was made up of 1.7m adult sheep and 2.55m lambs.

- The highest slaughter on record was reached in 1976- 6.46m, 70% of which was adult sheep. This was when we were predominantly a wool industry and had a much larger flock.

- Around 19% of domestic slaughter or 18m kg was consumed on the domestic market in 2022.

Meat exports

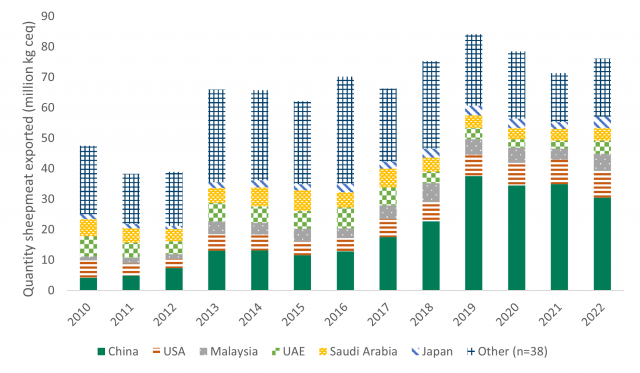

- In 2022 WA exported 76.2m kg of sheepmeat. This consisted of 32.9m kg of mutton and 43.3m kg of lamb.

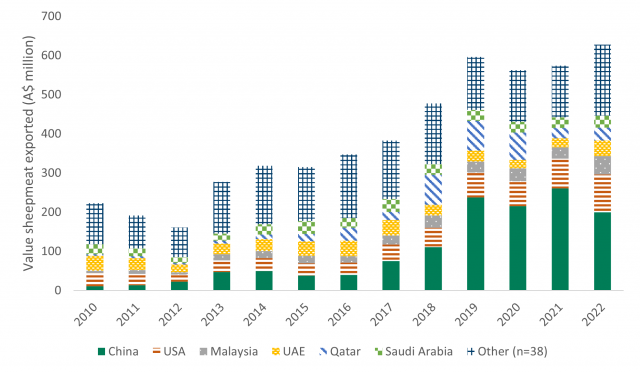

- Sheepmeat exports were worth $627.7m in 2022 (the highest on record)- $197.2m of mutton and $430.4m of lamb, also the highest on record.

- China was our largest market for sheepmeat accounting for 40% of the volume of sheepmeat exported. The USA followed with 12% and Malaysia was 3rd with 7%.

Live exports

- In 2022 WA exported 521,300 live sheep in total. WA accounted for 99.3% of the national total. WA live sheep exports were worth $80.6m in 2022 (sea and air).

- Of the total live sheep exported 508,400 were exported by sea, and all animals exported by sea departed via Fremantle. This was worth $75.8m.

- 12,400 were exported by air from Perth airport, plus 3850 from Sydney airport and 301 from Melbourne airport.

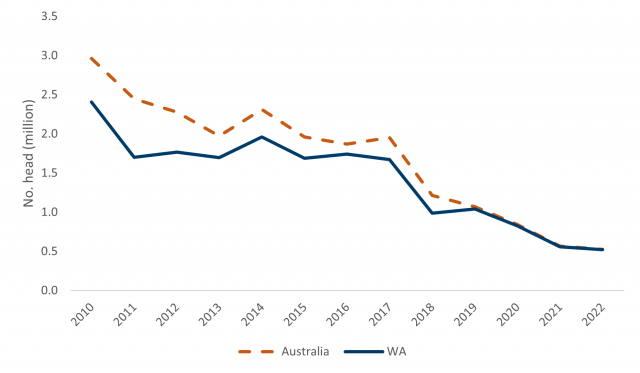

- Between 2011 and 2017 the number of sheep exported by sea remained relatively steady hovering between 1.7 and 1.9m head per annum. In 2018 and 2019 it fell to around 1.0m due to changing regulations and then declined to around 0.5m in 2021.

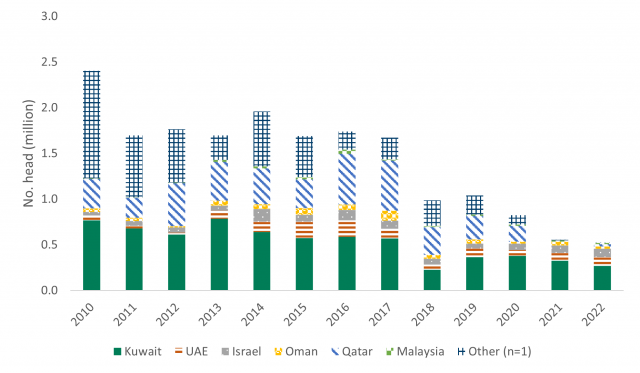

- Of the sheep exported live by sea in 2022, 53% were exported to Kuwait, 19% to the UAE, 18% to Israel and 5% to both Oman and Qatar (Qatar is believed to have stepped back into the market due to the Soccer World Cup).

Interstate transfers

-

In 2022 a total of 368,000 sheep were transferred interstate. This was made up of 247,000 lambs (67%) and 121,000 adult sheep (33%). This was down significantly on the 678,000 in 2021 and the 1.9m in 2020.

Wool

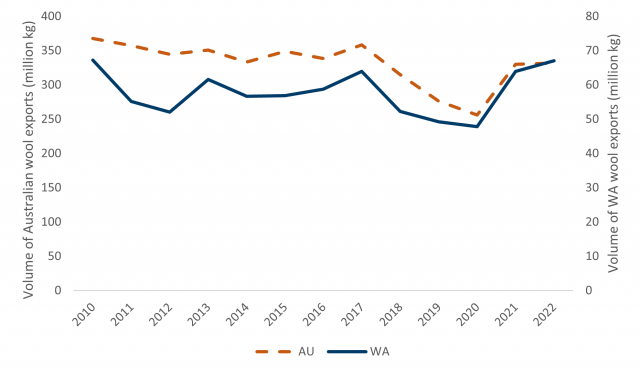

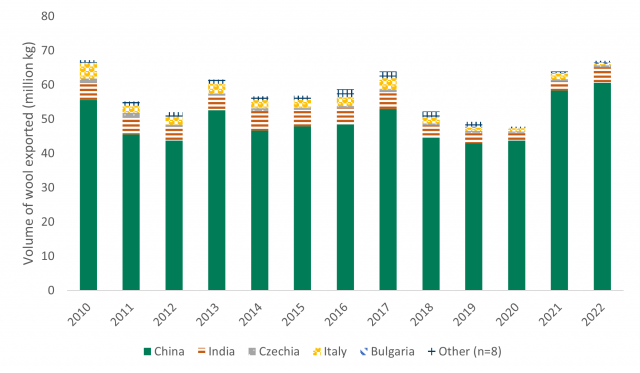

- The volume of wool tested for sale in 2022 reached 66.2m kg and made up 20% of the national volume of wool tested.

- The AWI shorn wool production final estimate for WA in 2021/22 was 61.2m kg with a wool cut per head of 4.6kg.

- WA wool exports totalled 67m kg worth $696.5m in 2022.

- 92% of WA wool exports were exported to China in 2022 and 7% to India.

The WA sheep industry

The contribution of the sheep flock to the WA economy

The WA sheep industry is an important contributor to the state economy. In 2021/22, the industry accounted for 43% of the value of all livestock industries in WA. The combined sheepmeat and wool industries contributed a gross value of production of $1.35b to the WA economy, up from $1.18b the previous year. Of the total contribution from the sheep industry, wool made up $655m or 21% of the value of all livestock industries, while the sheepmeat sector was worth $692m or 22% of the value of the livestock sector.

The WA sheep flock

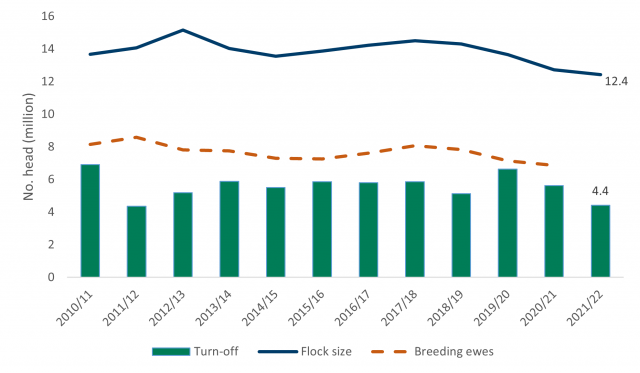

As of July 2022, the WA sheep flock consisted of 12.4m sheep and lambs. Following a period of relative stability between 2010/11 and 2018/19 where the flock hovered between 13.7 and 15.2m, the flock has started to decline falling to the lowest point on record since 1952 when the flock numbered 12.2m.

The total combined sheep turn-off, which consists of slaughter, live export and interstate transfers, was 4.4m head in 2021/22, a decline of 21% YOY and the lowest since 2011/12. This was largely due to the reduction in live sheep exports caused by regulatory changes, including the introduction of a mid-year trade pause for the northern hemisphere summer and reduced pen densities on board ships to reduce heat stress and the removal of major markets. Adult sheep slaughter was also below average. Over the previous five years total turn-off averaged 5.8m.

Sheep turn-off

As illustrated below, the largest component of WA sheep turn-off was lamb processing, which in 2021/22 made up 57% of the total sheep turn-off or 2.5m head. Lamb processing has increased in importance to the sheep industry in recent years, increasing as a proportion of turn-off from 30% in 2010/11 to 57% last year. Adult sheep processing accounted for 26% of turn-off in 2021/22, with 1.16m head. This figure has already been eclipsed in 2022/23, despite only having nine months of processing data to consider, with the total reaching 1.17m head at the end of March.

Live sheep export declined from 27% of turn-off in 2017/18, when the total exported was 1.6m sheep, to just 11% in 2021/22 with 487 000 sheep. Interstate transfers accounted for 6% of turn-off in 2021/22 or 268 000 sheep, a marked decline on the record breaking 1.4 million for the two years prior.

Domestic processing/slaughter

The largest segment of total-turn-off is that of domestic processing or slaughter. Total slaughter reached 3.8m in 2022 of which 69% were lambs and 31% were adult sheep.

Since 2012 there has been strong growth in the number of lambs slaughtered. In 2012 lamb slaughter totalled 1.6m head but increased to just over 3.0m in 2016, the highest on record. During calendar year 2022 it reached 2.6m, short of the record but a 2% increase YOY.

Sheep slaughter has been relatively steady over the last 10 years but is historically low when compared to figures seen prior to 2009. This is because export markets have become increasingly lamb orientated and the WA flock declined in numbers resulting in less adult sheep available for turn-off. In 2022 sheep slaughter totalled 1.2m head.

The highest total slaughter reached in WA was in 1976 when 4.5m adult sheep and 1.9m lambs were slaughtered totalling 6.4m head.

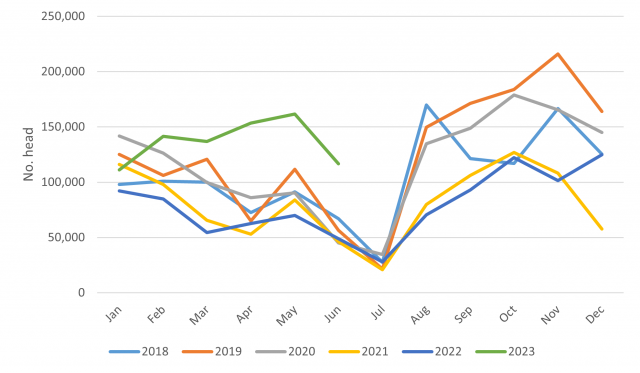

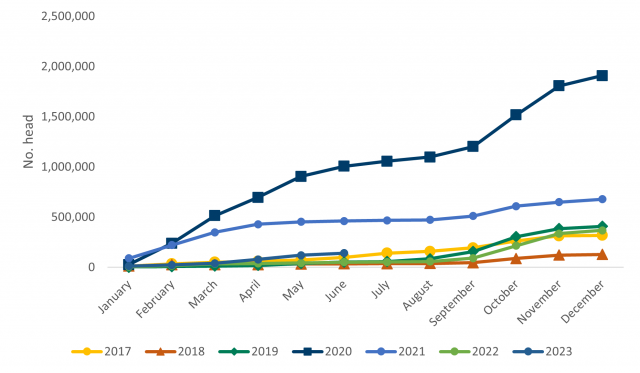

The below chart illustrates the seasonal nature of sheep slaughter in WA with the busiest time being during spring. July is the quietest month during which many or the local processors have 1-3 week shutdowns in order to carry out maintenance.

Lamb slaughter isn’t quite as seasonal as sheep slaughter and has become even less so in the last two years. Peak times are generally in spring from September to December, and in autumn between March and May when feed is in short supply.

Live sheep exports

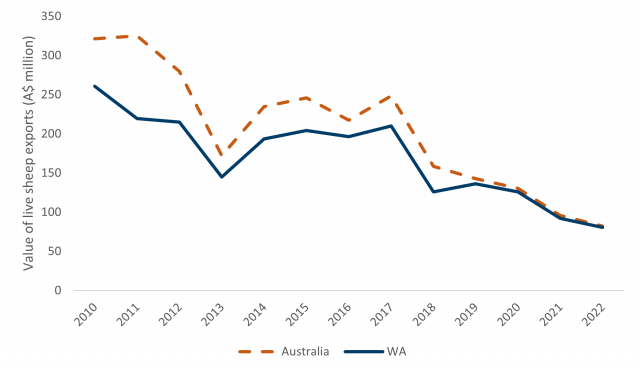

The majority of sheep exported from Australia originate in WA and 100% of sheep exported by sea are exported from Fremantle. The number of sheep exported live has been on a declining trend over the last decade or so. Sheep exported live declined from 2.6m in 2009 to 1m in 2019, a decline of 59%.

The sharp decline between 2017 and 2018 was largely due to the mid-year trade suspension and reduced stocking rates on ships imposed following the Awassi Express incident of 2017. Between 2019 and 2021 numbers declined again due to the loss of major markets such as Qatar following the removal of the subsidy for Australian sheep by the Qatari government. In 2022 live sheep exports from WA totalled 521,300, the lowest on record.

Live sheep exports are not very seasonal in nature other than the mid-year trade pause. Trade is very volatile from month to month and depends on outside factors such as available ships and international religious celebrations such as Eid/Ramadan, or even sporting events such as the World Cup.

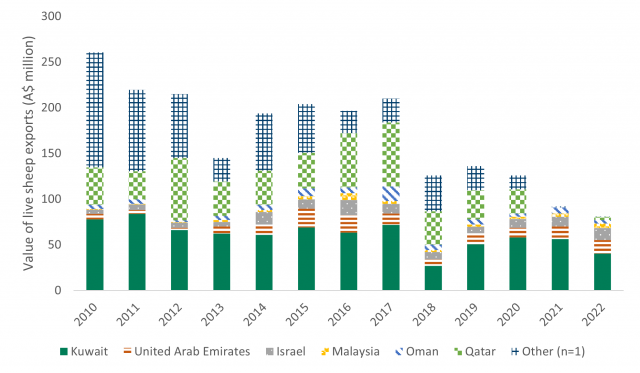

While not quite as consistent a decline as seen in the quantity of sheep exported live, there has been a likewise decrease in the value of live sheep exports, both nationally and from WA over the last decade. In 2019 live sheep exports from WA were worth $136m, but this dropped to $81m in 2022.

The largest market by both quantity and value for live sheep exports is Kuwait. Other than in 2018, Kuwait has been the largest market for over a decade. In 2022, WA exported 271 000 sheep worth $40.4m to Kuwait. This accounted for 52% of the quantity and 50% of the value of sheep exports. Kuwait was followed by the UAE, and Israel was the third largest market. These three markets together accounted for 88% of WA live sheep in quantity terms and 85% of the value.

Prior to 2011, Saudi Arabia and Bahrain were also large markets for live sheep from WA however, since then, both have exited the market. Oman was also much larger than it is today. It is clear that the Middle East maintains market dominance.

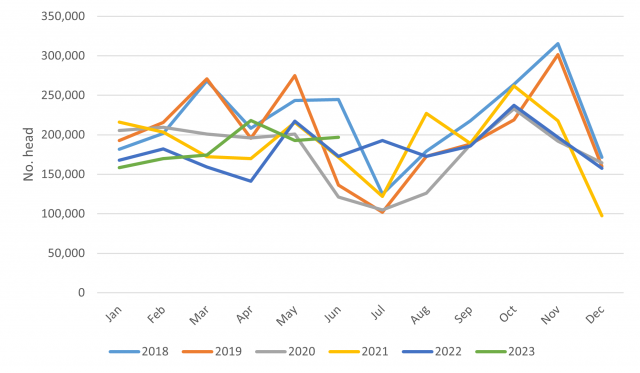

Interstate transfers

Between January and June in 2023 interstate transfers reached 142,000. This is 181% higher than at the same time in 2022 when 51,000 had been trucked east.

Despite this it is far below the 1m sent east in 2020 and 461,000 in 2021 at this time of year while the east was restocking following severe drought.

Of the sheep transferred interstate so far this year, 75% were lambs and 25% were adult sheep. Eastern states processors are active in WA markets due to WA’s discounted prices and backlog of animals awaiting slaughter in local processing plants.

Sheepmeat exports

In 2022, WA exported a total of 76.2m kg (ceq) of sheepmeat, a 7% increase YOY. This was driven by an increase in both mutton and lamb exports.

Mutton exports increased from 30.4m kg (ceq) to 32.9m kg (ceq), while lamb exports increased from 41.0m kg (ceq) to 43.3m kg (ceq) and the highest on record.

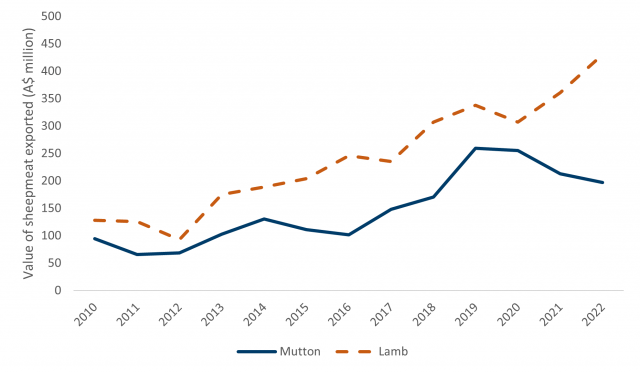

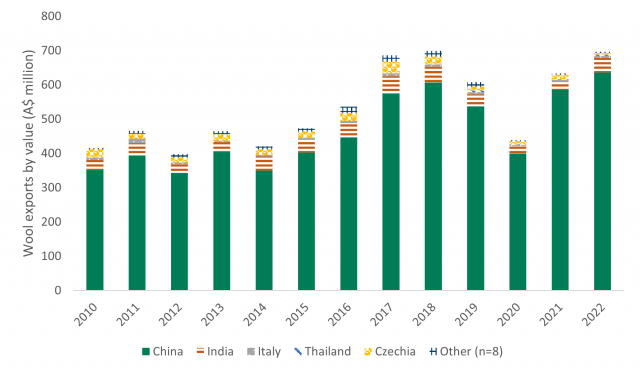

The value of both lamb and mutton exports increased steadily over the last decade reaching a combined total of $627.7m in 2022, the highest on record, up 5% on the second highest value reached in 2019.

Between 2010 and 2022, the value of WA mutton exports increased 108%, from $94.7m to $197.2m with a high of $259.2m reached in 2019. Year on year mutton exports have decreased 7% from $213.0m.

The value of WA lamb exports has also followed a positive trajectory, increasing from $128.2m in 2010 to $430.4m in 2022, an increase of 236% and the highest on record. Year on year, there was a 19% increase in value from $360.8m in 2021.

Over the last decade the growth of the Chinese market for WA (and Australian) sheepmeat in both value and quantity terms has been tremendous. China has been WA’s largest market for sheepmeat since 2012. In 2022, China accounted for 30.5m kg (ceq) of sheepmeat, or 40% of the quantity of sheepmeat exported. This equates to a value of $199.5m or 32% of the total value of sheepmeat exports. Despite this there was a YOY decline in sheepmeat exports to China in the order of 13% by volume and 24% by value.

Our second largest market was the USA and Malaysia came in third.

Wool production and exports

Wool production

In 2021/22, AWI estimated that WA produced 61.2m kg of wool. This was up from 56.5m kg in 2020/21, but 15% less than the high point of 71.8m kg seen in 2013/14. WA wool production may have increased YOY in 2021/22 due to reduced turn-off meaning the animals retained in the system required an extra shearing. AWI is predicting that 2022/23 wool production will total 60.6m kg.

Nationally wool production reached 324m kg in 2021/22, up 10% YOY from 294m kg. Above average rainfall in many parts produced abundant pasture feed allowing for further flock rebuilding and high fleece weights.

Wool exports

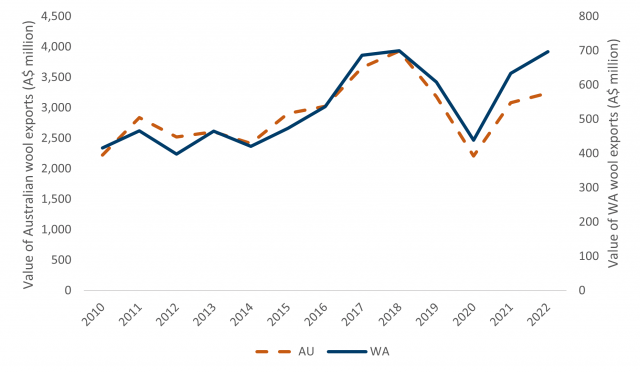

From 2017 there was a three-year decline in wool exports from both Australia and WA (Figure 18). In 2017, WA wool exports totalled 63.9m kg (greasy) but this fell to 47.8m kg in 2020, a fall of 25%. National wool exports fell by 28% over this time, from 358m kg in 2017 to 256.1m kg in 2020.

This decline in exports was due to a drop in demand and reduced production levels due to dry seasons. This was compounded by the outbreak of the Corona virus in 2020. The world’s largest consumers of woollen products are China, the USA and Europe. In China, domestic consumption of woollen products accounts for around half of their wool imports while much of the rest is exported to the EU and USA. Due to global shutdowns and the advent of working from home, demand for wool and woollen clothing dwindled.

In 2021 WA experienced a relatively swift recovery with the volume of wool exports reaching 63.9m kg and a further 67.0m kg in 2022, the highest it had been since 2010. Some of this wool may have been wool that had been stored on farm in the preceding years as farmers resisted the urge to sell while prices were low.

In value terms, wool exports have been on a strong upwards trend for the last decade, peaking in 2018 at $3.9b nationally and $699.6m in WA. This was largely due to strengthening prices and improving wool quality with an increase of finer wool being produced by more specialised wool producers. The value of exports in 2018 was the highest seen since at least the mid-90’s.

Following the high of 2018 the value of wool exports did decline to $438.7m in 2020 in line with lower volumes of wool being exported as well as weak prices due to lack of demand during the Corona virus outbreak. Since then however it has rebounded to $696.5m in 2022 as both the price and the volume exported has recovered to a degree.

China dominates WA’s wool exports and has done for well over a decade. In 2022, China accounted for 90% of the volume (60.6m kg greasy) and 91% of the value ($636.9m) of WA wool exports. Nationally, China accounted for around 80% of wool exports, making it the dominant player for the whole of Australia.

India was the second largest market for WA wool, taking 7% of wool exports, followed by Czechia with 0.8%.

Saleyard throughput

The sale of sheep via the saleyards has been on a downward trend for the last five years despite turn-off not declining at the same rate. This points to the use of alternative selling methods such as direct to abattoirs, use of online platforms or direct paddock sales.

Prices

Saleyard prices

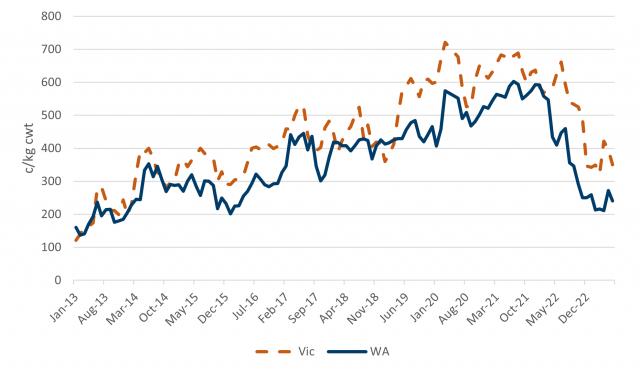

Over the last 18 months WA mutton indicators have been on a declining trend, a pattern reflected in Victorian saleyards as well. In April 2023 the WA price for mutton averaged 211c/kg, the lowest since Jan 2016. The prices started to decline following a peak of 592 c/kg in Jan 2022, however the highest on record was reached in August 2021 at 594 c/kg. In June 2023 it had lifted a little to 241 c/kg.

The falling prices may be due to reduced demand due to the large backlog of animals still awaiting processing after the labour issues experienced following the 2022 Corona outbreaks in WA.

Whilst not as marked as that seen in mutton, trade lamb saleyard prices have also declined recently. In June 2023 the trade lamb indicator averaged 474 c/kg cwt, down from a peak of 840 c/kg cwt in January 2022. This was also the highest on record. There was also a rise in value over summer when prices tipped 636 c/kg cwt in January 2023.

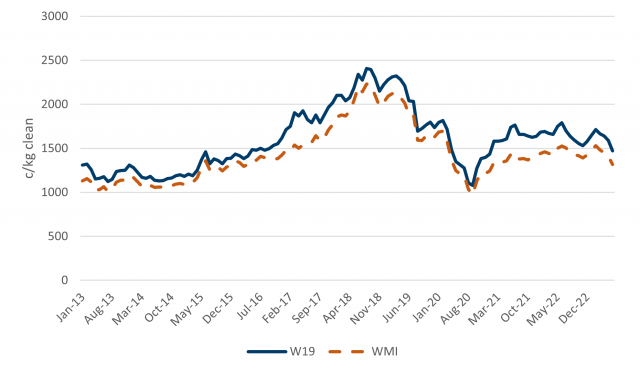

Wool prices

Wool prices have been relatively steady for the last 12 months after recovering from the steep decline experienced during the Covid era. Unfortunately they have not recovered to the highs seen in late 2018 when prices peaked at 2231 c/kg for the WMI and 2406 c/kg for the W19 (Aug 2018). In June 2023 the WMI averaged 1317 c/kg, down from 1409 c/kg the month before, while the W19 averaged 1471 c/kg down from 1590 c/kg.