Value of exports

Sheepmeat

Despite the volume of total sheepmeat exports increasing 11% year on year between January and October 2015 and the same time period in 2016, the value of WA sheepmeat exports has increased only 4% over the same time period, possibly due to reduced prices. Despite this though the projected end of year value for 2016 sheepmeat exports of A$328.8 million is the highest on record.

The value of WA lamb exports increased 10% year on year from A$172.0 million to A$190.0 in 2016, while mutton exports decreased 7% from A$90.1 million to A$83.5 million.

| WA | 2014 | 2015 | Jan-Oct 2015 | Jan-Oct 2016 | 2016p | Change |

| Mutton | 130.2 | 110.9 | 90.1 | 83.5 | 102.8 | -7% |

| Lamb | 188.5 | 204.3 | 172.0 | 190.0 | 225.6 | 10% |

| Total | 318.8 | 315.1 | 262.1 | 273.5 | 328.8 | 4% |

Australia as a whole has seen the value of sheepmeat exports fall quite dramatically between 2015 and 2016 as seen in Table 10. The value of total sheepmeat exports fell 7% when comparing the months January to October, while mutton exports fell 17% from A$607.5 million to A$502.2 million and lamb exports fell 3% from A$1468.7 to A$1425.0. The volume of Australian sheepmeat exports fell 2% during over that time.

| Australia | 2014 | 2015 | Jan-Oct 2015 | Jan-Oct 2016 | 2016p | Change |

| Mutton | 868.5 | 751.0 | 607.5 | 502.2 | 620.9 | -17% |

| Lamb | 1693.3 | 1774.3 | 1468.7 | 1425.0 | 1721.5 | -3% |

| Total | 2561.9 | 2525.3 | 2076.2 | 1927.2 | 2344.1 | -7% |

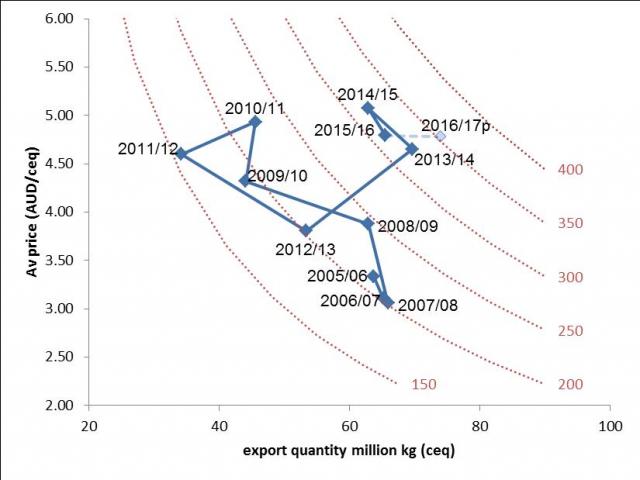

Figure 16 tracks changes in the quantity (horizontal axis, million kg carcase equivalents) and average price (vertical axis, AUD/kg ceq) of sheep meat exported from WA. The curved lines, isopleths, indicate points of equal total export value (labelled in AUD million (FOB)). Figure 16 illustrates the increase in the total export value of Western Australian sheepmeat between 2011/12 and 2016/17 (projected) from well under A$200 million to over A$350 million. Between 2013/14 and 2014/15 the average price received for sheepmeat exports increased quite sharply before declining in 2015/16. This is despite relatively high levels of product being exported. In 2016/17 it is projected that the average price per kg may decline slightly, however, the volume exported is expected to increase substantially as seen by the dashed horizontal line. The overall result is an increased total value of exports.

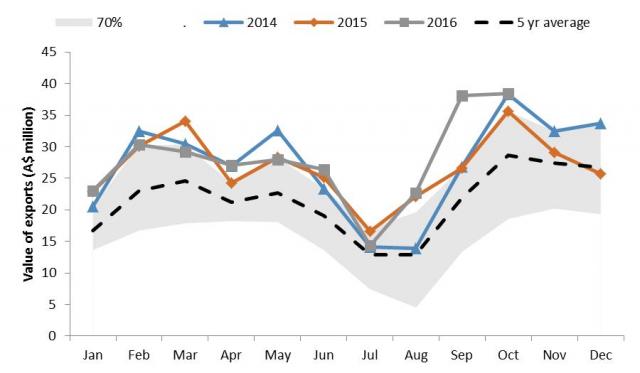

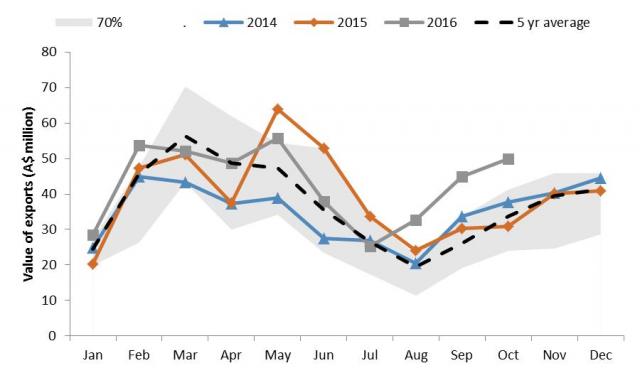

The 4% increase in the value of WA sheepmeat exports in 2016 compared to 2015 has largely occurred between August and October as seen below in Figure 17 where the value of exports exceeds both the previous two years, the five year average and the 70% range (2006-2015). The value of WA exports has remained well above the five year average every month so far in 2016.

The growth in the value of sheepmeat exports in recent years is quite evident in Figure 17, as the monthly value of exports from 2014 to October 2016 has generally remained above the five year average as well as staying close to the top of the shaded 70% range. This shows that the value of exports in these months has been in the upper reaches or exceeded 70% of the monthly value of exports between 2006 and 2015.

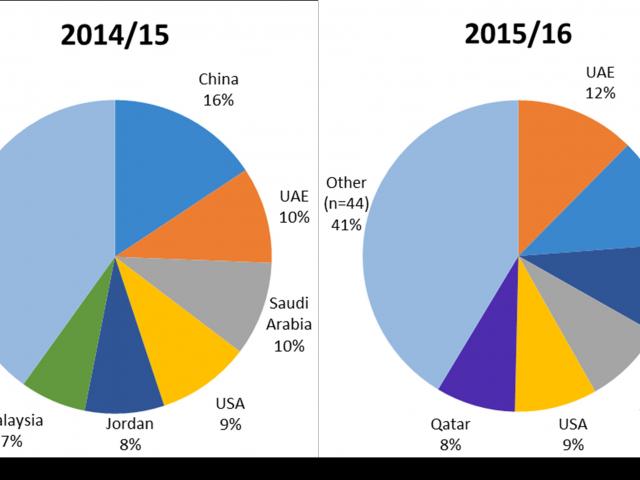

During 2014/15 China was the largest market for WA sheepmeat by value accounting for 16% of the total value of sheepmeat exports that year, however that fell to 11% in 2015/16 when China was surpassed by the UAE who accounted for 12% of the value of exports (up from 10%). Saudi Arabia accounted for 10% of WA sheepmeat exports in 2014/15, followed by the USA with 9%, Jordan with 8% and Malaysia with 7%. In 2015/16 Jordan accounted for 10% of the value of exports, followed by Saudi Arabia and the USA with 9%, and Qatar with 8%.

Live sheep export

Between January and October 2015 the value of WA live sheep exports totalled A$173.2 million. Over the same period in 2016 the value of live sheep exports fell 2% to A$169.8 million despite there being a 5% increase in the volume exported. If this trend continues for the remainder of 2016 it is projected that the value of live sheep exports from WA will total around A$200.2 million.

The value of live sheep exports from all of Australia fell by 9% when comparing January to October 2015 and the same time period in 2016, from A$208.9 million to A$189.1 million.

| 2014 | 2015 | Jan-Oct 2015 | Jan-Oct 2016 | 2016p | Change | |

| WA | 193.7 | 204.2 | 173.2 | 169.8 | 200.2 | -2% |

| Australia | 234.6 | 246.0 | 208.9 | 189.1 | 222.7 | -9% |

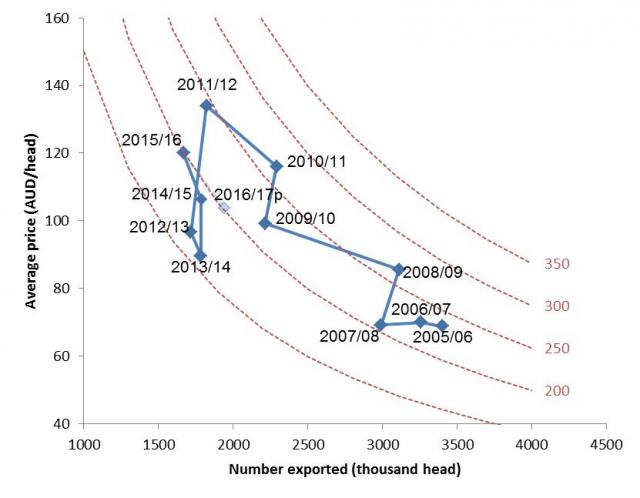

Figure 19 follows changes in the number and average value of live sheep exported between 2005/06 and 2016/17 (projected value). Between 2013/14 and 2015/16 the average value of live sheep exported increased dramatically from just above $80/head to around $120/head. Despite a projected decline in the average value per head in 2016/17 the volume is expected to increase from under 1.7 million to around 1.9 million (2016/17p), thus maintaining the total value of live sheep exports at about A$200 million.

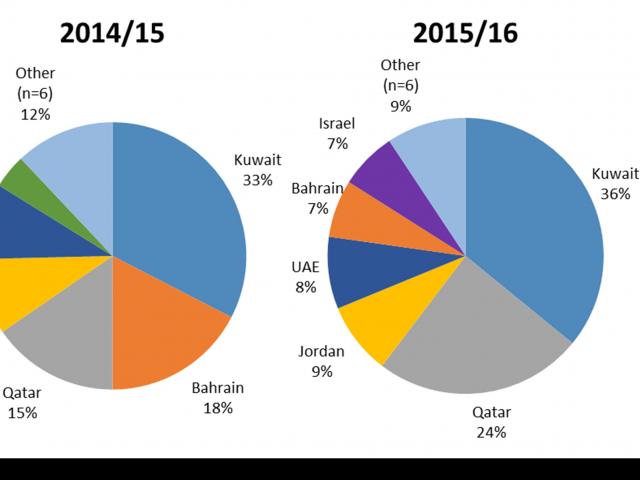

Similarly to that seen in the volume of live sheep exports, the largest market by value for WA live sheep exports is Kuwait. During 2014/15 Kuwait accounted for 33% of the value of WA live sheep exports and this increased to 36% in 2015/16 as seen below in Figure 20. The second largest market by value was Bahrain who accounted for 18% of the value of exports in 2014/15; however their market share fell to 7% during 2015/16. They were followed by Qatar with 15% in 2014/15 who increased their market share to 24% in 2015/16.

Wool

During the first ten months of 2016 the value of Western Australian wool exports increased by 10% from A$392.0 million in 2015 to A$429.5 million. If this trend continues WA wool exports would total around A$518.2 million by the end of the year. The value of WA wool exports haven’t reached this level since 2006 when it reached $530.4 million, largely due to a greater volume exported.

The value of Australian exports as a whole has increased slightly year on year (1%). Up until October 2015 the value of Australian wool exports totalled A$2385.2 million, whereas over the same time period in 2016 they have totalled A$2412.1 million.

| 2014 | 2015 | Jan-Oct 2015 | Jan-Oct 2016 | 2016p | Change | |

| WA | 420.2 | 473.0 | 392.0 | 429.5 | 518.2 | 10% |

| Australia | 2414.7 | 2909.0 | 2385.2 | 2412.1 | 2941.8 | 1% |

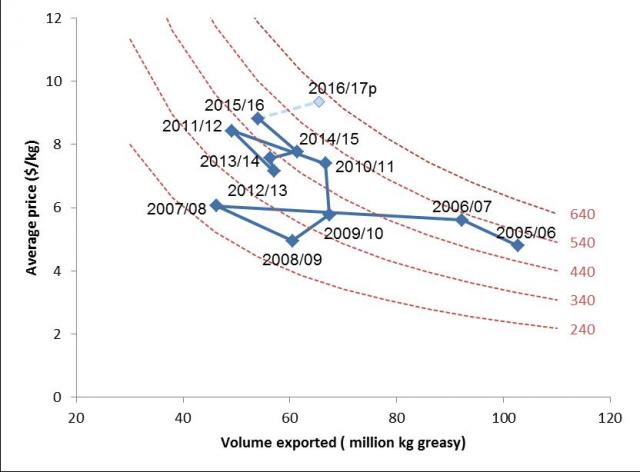

Figure 21 below follows the changes in the volume and average value of wool exported from WA between 2005/06 and 2016/17 (DAFWA projected value). Between 2005/06 and 2009/10, the volume of wool shifted lower while the average export price remained relatively steady. From 2009/10 until 2015/16, the volume exported declined from around 70 million kg to less than 60 million kg, while the average price has increased from around $6.00/kg greasy (FOB) to around $9.00 per kg greasy (FOB). In 2016/17p it is forecast that the volume exported may increase to around 70 million kg once again and the average price will further increase as well bringing the total value to the highest it has been in the last decade.

Between January and February 2016 the monthly value of WA wool exports was above the long term 70% range as seen below in Figure 22. This also occurred between August and October when it was much higher than both 2015 and 2014 and the five year average for those months as well as the 70% range. In a similar fashion to that seen in the volume of wool exports, 2016 bucked the trend by increasing in value in August when traditionally this is the lowest month for wool exports. Following past trends the monthly value of exports should increase from August until around November 2016.

The largest market by value for Western Australian wool exports continues to be China as seen below in Figure 23. During 2014/15 China accounted for 87% of the value of WA wool exports, followed by India with 7%, the Czech Republic with 4% and Italy with 1%. During 2015/16 China declined in market share to 83%, India accounted for 8% of exports, the Czech Republic remained steady at 4% and Malaysia displaced Italy accounting for 2% of the value of WA exports.