Quantity of exports

Sheepmeat

Between January and October 2016 total WA sheepmeat exports increased by 11% when compared to the same period in 2015, from 50.8 million kg to 56.6 million kg (Table 5). WA mutton exports remained relatively static, only falling from 24.0 million kg to 23.9 million kg. On the other hand lamb exports increased 22% year on year from 26.8 million kg to 32.7 million kg. If lamb exports continue at this rate it is projected to reach 39.5 million kg by the end of 2016.

| WA | 2014 | 2015 | Jan-Oct 2015 | Jan-Oct 2016 | 2016p | Change |

| Mutton | 35.4 | 29.9 | 24.0 | 23.9 | 29.8 | 0% |

| Lamb | 30.4 | 32.3 | 26.8 | 32.7 | 39.5 | 22% |

| Total | 65.8 | 62.1 | 50.8 | 56.6 | 69.3 | 11% |

The increase in exports to date in 2016 experienced by WA has not been shared on a national level as seen in Table 6. Total Australian sheepmeat exports have fallen 2% year on year.

| Australia | 2014 | 2015 | Jan-Oct 2015 | Jan-Oct 2016 | 2016p | Change |

| Mutton | 229.5 | 192.0 | 153.8 | 137.1 | 171.1 | -11% |

| Lamb | 290.4 | 299.0 | 244.6 | 251.8 | 307.7 | 3% |

| Total | 519.8 | 490.9 | 398.4 | 388.8 | 479.1 | -2% |

Figure 11 outlines the volume of WA sheepmeat exports by month between 2014 and 2016 as well as the five year average monthly volume exported (2011 to 2015) and the 70% range (the grey shaded area). The 70% range represents the range the volume of exports fall into each month for 70% of the time (2006 to 2015) illustrating seasonal variation.

As seen in Figure 11, other than December 2015, the volume of sheepmeat exported from WA has remained above the five year average every month between 2014 and 2016. During 2016 the volume of WA sheepmeat exports exceeded the grey shaded 70% range from August through to October illustrating the strength of exports in those months. Figure 11 illustrates the seasonal nature of sheepmeat export. There are peak export periods occurring during March and from October through to December, whilst July and August are the months where export volumes are reduced. This trend in exports correlates with lamb supply and pricing trends. During July and August lamb supply is tight and the prices peak, whilst in later months the spring flush occurs and prices are reduced which affects the availability of meat for export.

In 2014/15 the largest market for WA sheepmeat exports by volume was China accounting for 22% of total sheepmeat exported or 13.6 million kg ceq (carcase equivalent quantity). During 2015/16 China remained the largest market by volume; however the proportion exported to China fell to 18% or 11.7 million kg ceq.

The second largest market by volume in 2014/15 was Saudi Arabia who accounted for 11% of exports, followed by the UAE with 8%, the USA and Malaysia with 7% and Jordan who accounted for 6% of exports.

In 2015/16 the second largest market for WA sheepmeat was the UAE who accounted for 10% of exports, followed by Saudi Arabia and Jordan with 8%, Qatar with 7% and the USA who accounted for 6% of WA sheepmeat exports.

Live sheep export

So far during 2016 WA has seen positive growth in the live export of sheep. As seen below in Table 7, the number of sheep exported live from WA has increased 5% when comparing the first ten months of 2016 to that of 2015, from 1.42 million to 1.49 million sheep. If WA continues to export live sheep at this rate it is projected to reach 1.78 million head by the end of the year. Whilst an improvement on 2015 live exports, it is still short of the 1.96 million exported in 2014.

The increase in WA live sheep exports has not been repeated at a national level, with total Australian live sheep exports falling 1% so far in 2016 from 1.64 million to 1.62 million. It is projected to reach 1.93 million by year end.

So far this year WA has accounted for 92% of the volume of live sheep exported from Australia, up from 86% in 2015.

| 2014 | 2015 | Jan-Oct 2015 | Jan-Oct 2016 | 2016p | Change | |

| WA | 1.96 | 1.69 | 1.42 | 1.49 | 1.78 | 5% |

| Australia | 2.31 | 1.96 | 1.64 | 1.62 | 1.93 | -1% |

Since 2010, the largest market for Western Australian live sheep has been Kuwait. In 2014/15 Kuwait accounted for 33% of the volume of live sheep exported from WA. This increased to 37% in 2015/16 (Figure 13). The second largest market in 2014/15 was Bahrain with 17% of sheep exports, however, in 2015/16 Bahrain only accounted for 7% of exports after decreasing their WA sheep imports 63% year on year from 309 000 to 115 000. In October 2015 the Bahraini government removed the subsidy for Australian sheepmeat, thus making it more expensive for consumers and resulting in a drop in the trade. Qatar on the other hand has increased their sheep imports from WA from 280 000 (16%) to 427 000 (26%).

Wool

Despite a 9% increase in wool receivals in WA so far during 2016, WA wool exports have been relatively flat (Table 8). So far during 2016 WA wool exports have only marginally increased when compared to the same time period in 2015, from 47.8 million kg to 47.9 million kg. If the trend continues it is projected that approximately 57.0 million kg of wool may be exported from WA by the end of 2016 compared to 56.9 million kg in 2015.

There has been a drop in wool exports at a national level equating to a 5% decrease in the volume of wool exported during 2016 when compared to the same period in 2015. It is forecast that 331.1 million kg of wool may be exported from Australia by the end of 2016 if the trend continues.

| 2014 | 2015 | Jan-Oct 2015 | Jan-Oct 2016 | 2016p | Change | |

| WA | 56.7 | 56.9 | 47.8 | 47.9 | 57.0 | 0% |

| Australia | 333.2 | 349.0 | 290.5 | 275.6 | 331.1 | -5% |

As illustrated by Figure 14 below, the export of wool is of a seasonal nature with the largest volumes exported in March (2006-2015) as seen by the shaded 70% range. During 2016 the highest volume of wool was exported in May (6.3 million kg) rather than March, before falling significantly in July to 2.9 million kg. It did, however, buck the trend in August when it increased to 3.5 million kg rather than declining further. Between August and October the volume of wool exported from WA has remained well above the five year average for those months.

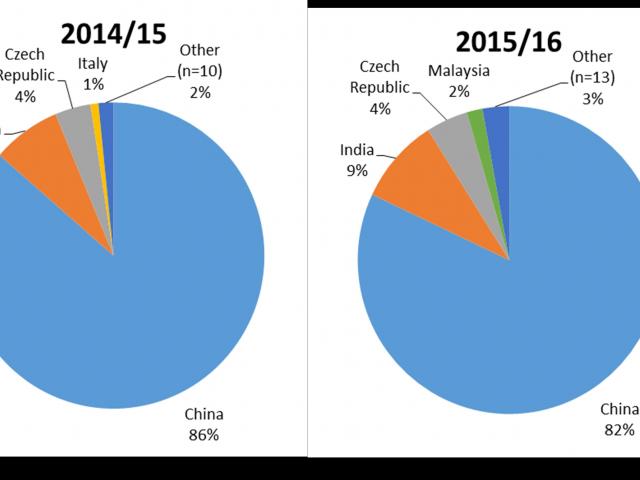

China continues to be the largest export market for WA wool as seen in Figure 15, despite declining from 86% of total wool exports to 82% between 2014/15 and 2015/16. India on the other hand increased their market share from 7% to 9% and the total number of markets increased from 14 to 17.