Model development

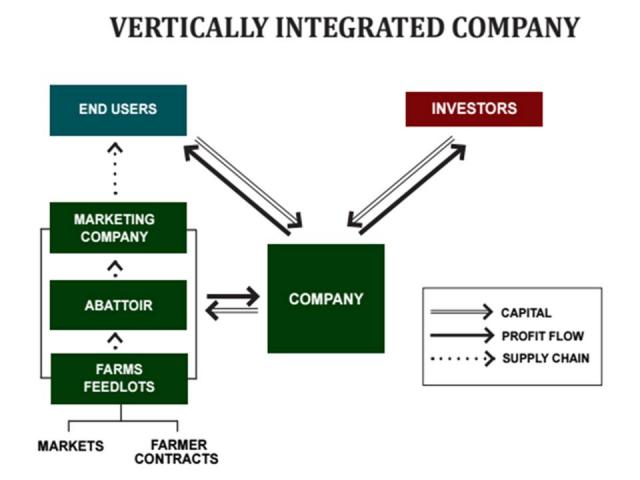

To overcome the constraints of the current market supply/demand model, a parallel model was proposed that focused on supply and sourcing new capital. The model that emerged is a vertically-integrated company with joint-venture financing, off-take agreements at both ends and end-user product specification, designed to attract institutional investment.

Early in model development, interviews were conducted in all sectors of the industry and found that:

- The current price and lack of long term contracts for producers in WA inhibits future production.

- There are multiple reasons for farmers withdrawing from sheep production.

- Young people are not being attracted to the industry.

- Processing companies do not offer a reliable contract kill service, therefore removing independent marketing options.

- The current ‘paddock to plate chain’ has multiple links, with each link adding complexity and cost to the final product.

- Economies of scale achieved with broadacre cropping is hard to replicate in sheep.

- Institutional capital is readily available for agriculture, but almost exclusively for large scale low risk organisations.

- The concept of ‘investment readiness’ is not agreed or shared.

- Information networks are not clear, information is often guarded.

- A collaborative state-wide investment conduit for agricultural investments is critical.

This is in sharp contrast to the positive view that demand is greater (by 10% annually) than food product supply in the Middle East and Asia.

Initially, four business models were identified from a range of options examined and reported in 'Concepts for alternative investment and financing models to expand sheep production in Western Australia'. The models, assessed as able to address the objectives, were joint-venture finance, a vertically-integrated company model, livestock leasing and pasture development.

Each model was examined by projecting productivity and profitability over a 5-10 year period. Timelines and potential costs of implementation were also examined whilst also noting constraints and opportunities of implementing such a model.

The composite model ultimately developed, a vertically-integrated company with joint-venture finance, addresses the model objectives and is the model most likely to be commercially achievable. It includes off-take contracts with end users, and the capacity and throughput of the abattoir is determined by the end-user's requirements. The company schedules the required number of sheep to arrive each day from its own farms, contracted farmers and markets, with backup livestock volume held to cover any shortfall.

Supply increase and continuity of production are central to the model development.

The model incorporates:

- a forecast demand that is robust

- the model must guarantee reliability of supply

- a product of superior quality will be produced

- a superior quality product will justify a premium price

- overseas customers are currently paying premium prices for quality products

- the product must be safe

- capital to develop new projects will be difficult to source.