Competitor analysis - New Zealand

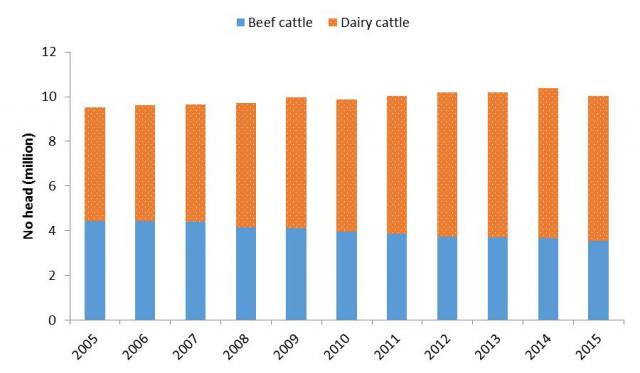

The New Zealand cattle industry is comprised of beef cattle and a large dairy cattle component. The total cattle population in New Zealand during 2015 was 10 million head, down from 10.4 million in 2014, as seen in Figure 19. This consisted of 3.5 million beef cattle and 6.5 million dairy cattle (Statistics New Zealand).

Due to recent growth in the New Zealand dairy industry, which has caused displacement of beef cattle and other animals, there has been a downward trend in the number of beef cattle. The proportion of dairy cattle has grown from 53% in 2005 to 65% in 2015, as illustrated in Figure 19 (Statistics New Zealand).

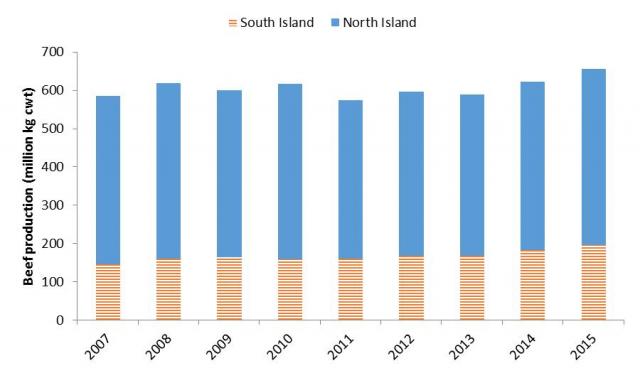

New Zealand beef production generally peaks during late autumn or early winter when dry conditions and low feed availability cause producers to sell down. Calf slaughter generally occurs in August and September when the dairy herds are calving (MLA). Around 70% of beef is produced in the North Island, as seen in Figure 20.

New Zealand has a relatively small beef industry compared to Australia. In 2015, New Zealand’s beef production totalled 656 million kilograms of beef compared to Australia’s 2547 million kilograms. Despite this, New Zealand is a major international competitor, exporting about 95% of production (MLA). Between 2013 and 2015, beef production increased 11% from 589 million kilograms to 656 million kilograms, due in part to the growth of the dairy sector as excess animals were turned off for meat (Figure 20).

Most of the beef exported from New Zealand is manufacturing beef from cull cows, a by-product of the dairy industry. The largest export destination by volume is North America which took over 150 million kilograms during 2014/15, followed by North Asia which took over 60 million kilograms. North Asia is a quickly-growing market and so far in 2015/16 has grown to 80 million kilograms, due largely to growth in the Chinese market (Beef & Lamb NZ).