Summary

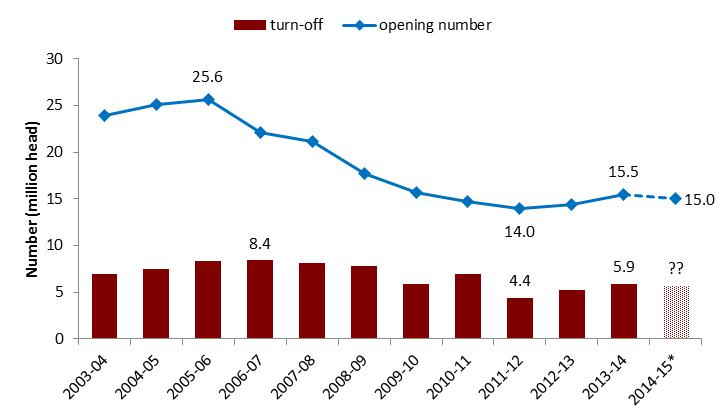

- The Western Australian sheep flock declined to 14.0 million head in 2011, then increased to 15.5 million in 2013, but is forecast to have slipped back to 15.0 million in mid-2014.

- The 2013/14 decline in the flock has been driven by strong turn-off with lamb slaughter up 25% to 2.39 million, sheep slaughter up 9% to 1.56 million and live exports up 4% to 1.78 million, for a total of 5.9 million head including 0.16 million trucked across the Nullarbor.

- The total value of Western Australian sheep and lamb meat exports in 2013/14 was A$324 million, up a massive 60% on the previous year. These exports were dominated by the Middle East (39%, mainly United Arab Emirates, Saudi Arabia and Jordan), China (16%) and the USA (11%).

- Both the saleyard and over the hooks indicators for lamb and mutton have increased steeply during 2013/14. The lamb indicators are only slightly lower than those reported at the previous peak in July 2011. The mutton indicators have not yet achieved the levels seen in 2011, but are 70-80% higher than where they were in early 2013.

- Live sheep exports worth A$160 million were largely split between three key markets – Kuwait (36%), Qatar (22%) and Jordan (18%). Western Australia supplied 88% of all Australian live sheep exports during 2013/14, the highest proportion for over 10 years. The previous significant market of Saudi Arabia was absent during 2013/14.

- Export wether prices rose sharply to above A$100 per head in May 2014, but have since slipped to around A$80, about A$15/head above the average quotation in 2013.

- Wool production in 2012/13 and 2013/14 delivered modest year-on-year increases of 2% and 6% respectively. While the Western Market Indicator has been generally above the median price of the last 10 years, the premium for fine wool has fallen to around 2-3%. This has been particularly difficult for fine wool producers who depend on wool rather than lamb for the majority of their income.

- The expected ongoing strong export demand for sheep and sheep meat suggests that the WA flock will struggle to expand in the near term, and that prices are more likely to rise.

Flock size and dynamics

The Western Australian sheep flock was sold down sharply between 2005 and 2011. Between 2011 and 2013, flock rebuilding resulted in an increase of 10% from 14.0 million head to 15.5 million head as demonstrated in Figure 1.

Since 2006/07, turn-off, including lamb and sheep slaughter, live export and interstate movements, has fallen from 8.4 million head to 4.3 million head in 2011/12 before rising to 5.9 million in 2013/14. The reduction in turn-off in 2009/10 resulted from producers choosing to retain ewe lambs and older ewes to rebuild or stabilise their flocks in response to improving prices. The severe dry season in 2010, coupled with near record prices for sheep and lambs led to a significant sell off in the second half of 2010 and early 2011. This had the flow on effect into 2011/12 of reducing industries’ turn-off capability resulting in a record low turn-off. Figure 1 also demonstrates the narrowing of the margin between total flock numbers and turn-off, indicative of an increased focus on meat production.

In 2013-14, strong turn-off is expected to drive a decrease in the Western Australian flock.

Figure 1. Opening number of sheep[1] on farms and total turn-off for WA (Figures based on Australian Bureau of Statistics (ABS) data, analysed by the Department of Agriculture and Food, Western Australia (DAFWA))

[1] The 2014/15* opening number is a Department of Agriculture and Food WA forecast.